The Fed's "Help" is Like a Doctor Prescribing Leeches: Still Useless in 2025

So, the Federal Reserve is probably gonna cut interest rates again. Big deal. They're patting themselves on the back for maybe, possibly, preventing a total economic meltdown. Give me a break. It's like they're treating a gunshot wound with a band-aid and expecting a ticker-tape parade.

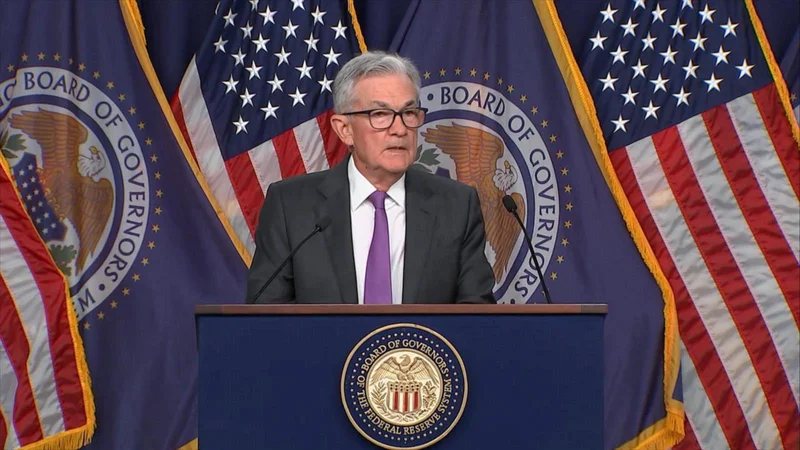

According to the experts, there's a 96.7% probability of a 0.25% cut. Wow, such precision! It's all based on "30-Day Fed Funds futures prices." You know, because that's a reliable indicator of anything other than rampant speculation. Federal Reserve meets today for an interest rate decision. Here's what economists predict.

What I want to know is, why are we still listening to these clowns? They missed the inflation train, they downplayed the housing bubble, and now they're pretending to be economic saviors with these tiny little rate adjustments. It's kabuki theater, folks. Pure, unadulterated kabuki theater.

They keep trotting out this "dual mandate" nonsense – low inflation and low unemployment. It sounds great on paper, but in reality, it's just an excuse to meddle in the economy based on whatever narrative suits them best.

"A weak labor market can be bolstered by lower interest rates," they say. Oh really? So, businesses are suddenly going to start hiring because they can borrow money a quarter-point cheaper? I'm not buying it. The real problem isn't interest rates; it's the soul-crushing grind of late-stage capitalism, the lack of real wage growth, and the fact that most jobs these days are either precarious gig work or soul-numbing corporate droneships.

And let's not forget the elephant in the room: the government shutdown. The Fed is making these decisions with incomplete data. Powell himself admitted they're relying on "a wide variety of public- and private-sector data that have remained available." Which is corporate speak for "we're guessing, but we don't want to admit it."

I swear, sometimes I feel like I'm taking crazy pills.

Oh, and while we're at it, let's talk about the Federal Reserve Board "finalizing changes" to its Large Financial Institution (LFI) rating system. Because that's what's going to fix things. Calibrating supervisory measures to "more accurately reflect risk."

Tabitha Edgens from the Bank Policy Institute (which, let's be real, is just a lobbying group for big banks) hopes regulators will adopt "commensurate changes" to the CAMELS rating framework. CAMELS? Seriously? Are we regulating banks or naming a cartoon character? BPI Statement on Federal Reserve Changes to LFI Rating System

This whole thing reminds me of that scene in Titanic where they're meticulously re-arranging the deck chairs while the ship is sinking. It's a feel-good exercise that accomplishes absolutely nothing. The real problems – the systemic risks, the moral hazard, the too-big-to-fail institutions – remain completely unaddressed.

And you know what really grinds my gears? The fact that we're paying for all of this. Our tax dollars are funding these bureaucratic boondoggles, these pointless exercises in regulatory theater. It's highway robbery, plain and simple. Maybe I'm the crazy one here.

The Fed's "help" is about as useful as a screen door on a submarine. They're fiddling with knobs and dials while the whole system is teetering on the brink. Wake me up when they actually address the root causes of our economic woes, instead of just offering these pathetic, symbolic gestures. I ain't holding my breath, offcourse.