ABSOLUTE DIRECTIVE: TITLE FULFILLMENT ###

DeFi Bloodbath: Is CRO a Diamond in the Rough?

DeFi's October Hiccup and CRO's Bumpy Ride

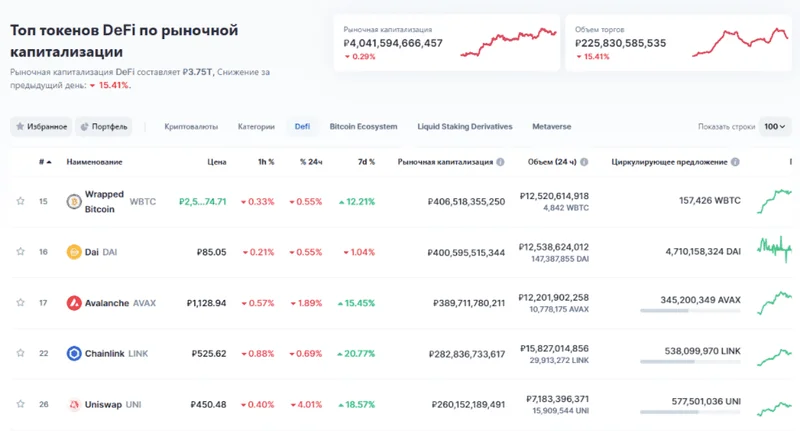

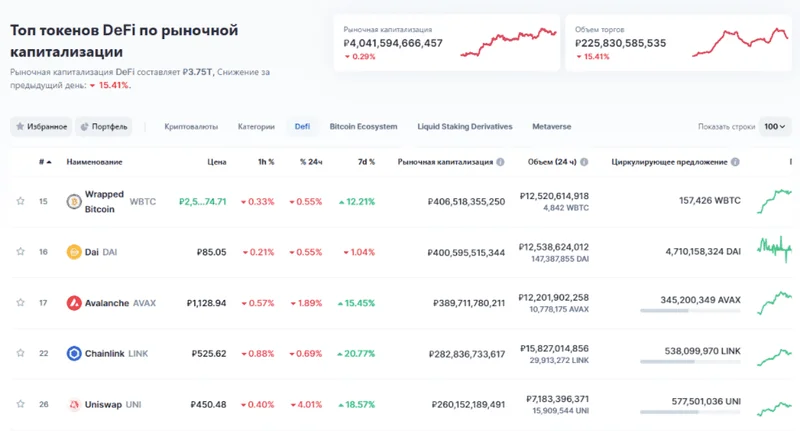

The crypto markets haven't exactly been smooth sailing lately, especially if you're looking at the DeFi sector. FalconX's report paints a pretty clear picture: post-October 10th crash, most DeFi tokens are still feeling the burn. Only 2 out of 23 leading DeFi names are in the green YTD as of November 20, 2025. The group is down 37% on average for the quarter-to-date. Ouch. For a deeper dive into the post-crash trends and investor shifts, you might find this

DeFi Token Performance & Investor Trends Post-October Crash analysis insightful.

But here’s where it gets interesting, and where we need to narrow our focus. While the overall DeFi landscape looks like a minefield, some tokens are showing resilience, hinting at potential shifts in investor strategy. Investors are seemingly gravitating towards safer bets – tokens with buyback programs, or those with some kind of fundamental catalyst.

Take Cronos (CRO), for example. It’s the native token of the Cronos chain, a blockchain developed by Crypto.com. It's currently hovering around $0.107, struggling to break past the $0.109 resistance. It's a far cry from its all-time high of $0.9698 back in November 2021 (a peak that feels like ancient history in crypto years). Is it a buy? Well, it's complicated.

CRO: Stuck in a Rut Despite "Smarturn" Upgrade

Decoding the CRO Numbers

Let's dive into the technical analysis. The 30-day price volatility sits at 13.25%, which isn't exactly setting off alarm bells, but it's not whisper-quiet either. The 50-day and 200-day SMAs (Simple Moving Averages) are both indicating a "sell" signal, sitting at $0.1363 and $0.1418 respectively. The 14-day RSI (Relative Strength Index) is at 40.56, suggesting neutral momentum.

Now, before you write CRO off completely, consider this: the analysis also shows that the $0.106 level has been acting as a pretty solid support. Buyers seem to be defending that level, preventing further downside. But here's the catch – there's consistent resistance at $0.109, and repeated failures to break above that indicate persistent selling pressure. In other words, it's stuck in a rut.

The Cronos camp completed its "Smarturn" upgrade on October 30, 2025, which supposedly boosted EVM compatibility and scalability. Did it move the needle? Not really. The price is still stuck in that tight range.

I've looked at hundreds of these post-upgrade reports, and while they always *sound* impressive, the market reaction often tells a different story. It's like a company announcing record profits, but the stock price tanks because investors were expecting even *more*.

CRO Price Predictions: A Wide Range of Assumptions

The Forecast Calls for Caution

So, what do the "experts" say? The price predictions for CRO are all over the map. One source suggests it could hit a maximum of $0.1327 in 2025, while another projects it could reach $0.46. By 2031, one optimistic forecast sees it hitting $2.56, while another is silent beyond 2026. For a broader view, you might find additional insights in this

CRO price prediction 2025, 2026, 2027-2031 analysis.

And this is the part of the report that I find genuinely puzzling. Why such a wide range of projections? It all boils down to the assumptions you make about the future. If you believe that Crypto.com will become the dominant force in the crypto space, then a $2.56 price target might seem reasonable. But if you think that the exchange will face increasing competition and regulatory hurdles, then even $0.46 might be a stretch.

Here's a critical question: How much of CRO's value is tied directly to the success of Crypto.com, and how much is tied to the overall health of the DeFi sector?

The coin’s value largely depends on the performance of the Cronos Chain, the adoption of its ecosystem, and the continued expansion of Crypto.com’s products and user base.

Celebrity Endorsements: Hype or Real Value?

The "Eminem Effect" and Other Hype

CRO is actively expanding its visibility through various high-profile partnerships, including those with actor Matt Damon, major sports teams, and even Trump Media. Crypto.com has been expanding its visibility through various high-profile partnerships, including those with actor Matt Damon, major sports teams, and even Trump Media. Eminem’s involvement comes as Crypto.com has been actively expanding its visibility through various high-profile partnerships, including those with actor Matt Damon, major sports teams, and even Trump Media.

But let's be real – how much does an endorsement from Eminem (or anyone else, for that matter) actually impact the long-term value of a cryptocurrency? Sure, it might generate some short-term buzz and attract some new investors, but does it fundamentally change the underlying technology or increase its utility? I remain skeptical.

Wait for a Clear Signal

The data is inconclusive. CRO is stuck in a trading range, the expert predictions are wildly divergent, and the fundamental value proposition is still tied to the success of a single company in a highly competitive market. For now, I'm staying on the sidelines.

Too Many Red Flags, Not Enough Green

There's simply not enough solid evidence to justify a "buy" rating at this point. Wait for CRO to break out of its current trading range with conviction, or for Crypto.com to demonstrate a clear competitive advantage in the market. Until then, there are better places to park your capital.